Summary

This proposal seeks to expand the MetalSwap ecosystem by deploying the Hedging Swap tool on the Optimism Layer 2 Optimistic Rollup network. This integration is anticipated to significantly reduce transaction fees, thereby increasing user accessibility. In addition, we propose the distribution of a prestigious OP token grant received from Optimism Growth Experiment Cycle 11 to incentivize users of our platform.

Background and Context

MetalSwap deployed the Hedging Swap smart contracts on Ethereum’s mainchain in September 2022. As rightly said in the draft, the fluctuating transaction fees on Ethereum Mainnet have hampered user accessibility to MetalSwap’s hedging tool.

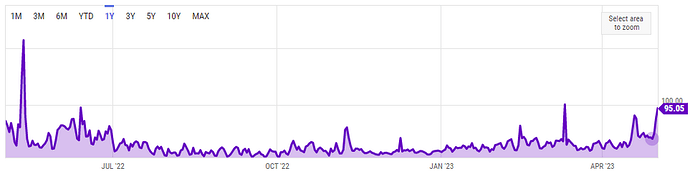

Since then, the Average Gas Price on Ethereum has fluctuated from 10 to 100 Gwei

and the ETH price has swung from 1100$ to 2100$.

This means that the cost of tx fees has fluctuated between $5 and $80, a significant cost for medium and small operations.

The deployment of the Hedging Swap’s Smart Contracts on Optimism Layer 2, an established scaling solution, would mitigate these costs and align MetalSwap with other advanced protocols in the DeFi space.

Moreover, MetalSwap won the Optimism Growth Experiment Cycle 11 Grant, providing the possibility to distribute 30,000 OP tokens to incentivize dApp users. To fully leverage this opportunity, it is proposed to distribute these tokens upon deployment of the Hedging Swap smart contracts on the Optimism Layer 2.

Proposal Details

The proposal entails the following key points:

Deploy the Hedging Swap smart contracts on Optimism Layer 2 - This integration will dramatically reduce transaction fees and the Premium for opening a new Hedging Swap due to lower settlement fees. Additionally, it will enable the distribution of both OP and XMT as Rewards to dApp users.

XMT Bridging - This will be facilitated from Ethereum to Optimism through the Official Op Bridge to distribute it as governance liquidity reward.

Initial liquidity provisioning - As a kickstart, the DeFi Foundation will provide approximately $10,000 worth of liquidity for each asset (WETH, WBTC, and OP) and $30,000 worth of USDC as a counterbalance to manage the initial Liquidity Pools.

USDC is the chosen stablecoin due to its massive usage through Optimism’s network.

Distribution of the OP Grant and XMT governance tokens - A two-fold distribution strategy is being studied, with one pool dedicated to Liquidity Providers and another for the Hedging Swap side. The OP are going to be distributed as set with the Grant management, and the XMT will always be the Reward for Swappers and Liquidity providers, as it is on Ethereum mainchain.

Buyback - The collected Premiums, in accordance with MetalSwap’s whitepaper, will be converted into XMT for 80% and distributed in an Ethereum Mainnet’s SmartPool.

Timeline and Milestones

T1: DAO approves the MIP

T2: Deployment of the Hedging Swap Smart Contracts on Optimism Layer 2

T3: Initial Liquidity Providing for Hedging Swap Pools

T4: Hedging Swap Tool on Optimism goes live with Distribution of the OP and XMT governance tokens

This proposal aims to achieve these milestones within a period of 2 months.

Cost and Resource Estimates

The DeFi Foundation will cover the entire cost of the operation, including the cost of Smart Contracts and feature development. This will be facilitated using the Funds raised for the development of the project. Additionally the DeFi Foundation will provide an initial liquidity of $60,000 (10k$ WETH, 10k$ WBTC, 10k$ OP, and 30k$ USDC). Additional resources required include some coins to pay the common fees for bridging, contracts deploying, and token managing.

Conclusion

The integration of the Hedging Swap tool with the Optimism Layer 2 solution and the distribution of the OP token Grant presents a significant opportunity to expand the MetalSwap ecosystem and incentivize its usage further. This proposal underscores our commitment to technological innovation and improved user experience.

As the Foundation takes over the MPI by creating an on-chain vote spanning a duration of 3 days, the voting period starts as soon as possible to align with the OP Grant Critical Milestones. The chosen voting period will be from the 17th of May, to the 20th of May, and the QUORUM of 20M $XMT must be reached in order for the vote to be valid.

We recommend clicking the Self Delegate button if you haven’t before with those particular public addresses you want to involve in voting, or you will not be able to take part in the incoming proposal.

For other hints about how to vote you can consult MetalSwap’s Official Docs dedicated section.

We welcome and encourage open discussion from this moment to the end of the voting period, and collaboration as we collectively strive to build a stronger, more innovative, and accessible Decentralized Hedging Swap platform.

Your participation in shaping the future of MetalSwap is invaluable. Let’s work together to make this proposal a reality.

The future of MetalSwap is in your hands. Let’s shape it together! Happy voting!