This proposal aims to expand MetalSwap’s ecosystem by deploying the Hedging Swap tool on the Optimism Layer 2 Optimistic Rollup network.

Background and Context

MetalSwap deployed the Hedging Swap smart contracts on Ethereum’s mainchain in September 2022.

The transaction fees on Ethereum Mainnet have an important impact; they can decrease users’ accessibility to the hedging tool.

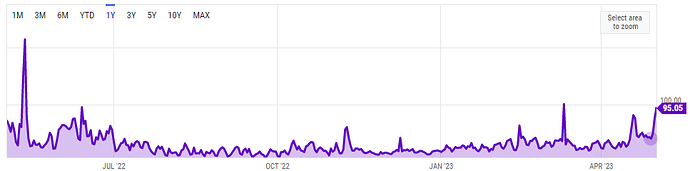

Since then, the Average Gas Price on Ethereum has fluctuated from 10 to 100 Gwei

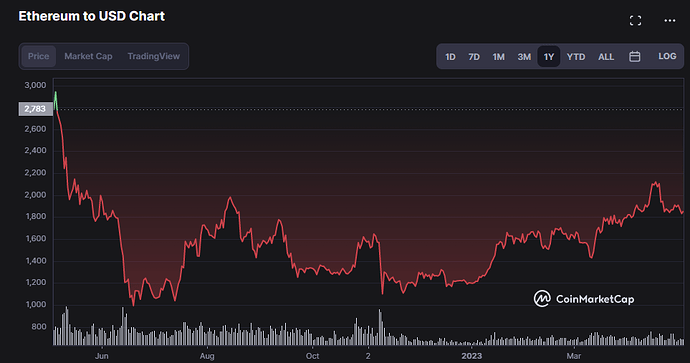

and the ETH price has swung from 1100$ to 2100$.

This means that the cost of tx fees has fluctuated between $5 and $80, a significant cost for medium and small operations.

The impact that the tx fee has on the cost of the individual position includes the network cost and the settlement fee.

Rollup technology would bring down these costs.

The DeFi ecosystem has been developed a lot on Optimism as a scaling solution. Other protocols of financial derivates have taken this path, this could also be the case for MetalSwap.

For these reasons MetalSwap applied for the Optimism Grant.

MetalSwap won the prestigious Optimism Growth Experiment Cycle 11 Grant, which will make available 30,000 OP tokens as incentives for dApp users. To fully embrace this opportunity, the intention is to deploy the Hedging Swap smart contracts on the Optimism Layer 2.

Proposal Details

Deploy the Hedging Swap smart contracts on Optimism Layer 2 Optimistic Rollup network.

This integration will allow MetalSwap’s users to tap into Optimism’s lower fees, which will in turn:

-

drastically lowering the tx fees

-

reduce the Premium for Opening a new Hedging Swap due to a minor cost of settlement fees.

-

have the possibility to reduce the minimum Target Size due to a less commission cost.

-

will make it possible to distribute OP as well as XMT as Rewards to dApp users.

In addition, to increase the possible users of the protocol i propose to insert OP Token as an Hedging Swap asset to allow OP holders to hedge against the volatility of the Optimism governance token. This is a critical milestone for obtaining the 30kOP incentive.

I think that the other two Hedging Swap assets should be WBTC and ETH, to enable DeFi user to hedge against price volatility with much lower costs.

- XMT Bridging

XMT Bridging will be enabled from Ethereum to Optimism through the Official Op Bridge to distribute it as governance liquidity reward.

- Initial liquidity provisioning

As a support to the kickstart of the Hedging Swap Service, the DefiFoundation should provide approximately $10,000 worth of liquidity for each asset (WETH, WBTC, and OP) and $30,000 worth of USDC as a counterbalance, for a total starting liquidity of 6/6 - 60k$ countervalue.

USDC is the stablecoin with the most liquidity in the OP ecosystem.

- Distribution of the OP Grant and XMT governance tokens

I propose a two-fold distribution strategy, with one pool dedicated to liquidity providers and another pool for the hedging swap side. I also suggest implementing a distribution formula where the maximum OP reward decreases gradually as it is distributed, with smaller and smaller rewards, but never reaching zero in the short term. This approach will incentivize users to participate early on and maintain interest in the platform.

So the reward will be of double-asset: XMT and OP

- Buyback

The collected Premiums, as stated in MetalSwap’s whitepaper, are going to be changed in XMT for the 80% and distributed in an Ethereum Mainnet’s Smart Pool that will be created when the current ongoing one will finish its locking period.

- Timeline and Milestones

T1: Approval of the MIP by the DAO

T2: Deploy of the Hedging Swap Smart Contracts on Optimism Layer 2

T3: Hedging Swap Pools initial Liquidity Providing

T4: Hedging Swap Tool on Optimism Live with Distribution of the OP and XMT governance tokens

The idea is to achieve these objectives within 2 months

- Cost and Resource Estimates

The entire cost of the operation, including the cost of Smart Contracts and feature development, should be covered by the foundation, which will use the Funds raised for the development of the project.

The MetalSwap Foundation should provide the initial liquidity, totaling $60,000 (10k$ WETH, 10k$ WBTC, 10k$ OP, and 30k$ USDC). Additional resources required for implementation are surely some coins to pay the common fees for bridging / contracts deploying / token managing.

The Defi Foundation should provide the necessary XMT to reward both the Hedging Swap side and the Liquidity Providing side, just like on the Ethereum dApp.

Conclusion

Integrating the Hedging Swap tool with Optimism Layer 2 solution and distributing the OP token Grant are exciting opportunities to expand MetalSwap’s ecosystem and further incentivize MetalSwap’s usage.

If the foundation will take over the MPI by creating an onchain votespanning a duration of 3 days, i propose the voting period to start as soon as possible to match the OP Grant Critical Milestones.

I encourage open discussion and collaboration as we work together to build a stronger and more innovative Decentralized Hedging Swap platform.