Hi all,

I am delighted to share the news that the Swap Competition has made its return! Upon careful observation, it has come to my attention that by adhering to specific parameters such as Target Size, Expiration, Set Cover and with the Pool Balancer unbalance how is it now, the costs associated with initiating a position can be entirely offset through the use of OP.

Given our current post-Halving environment and the anticipation of significant market movements, now presents an ideal opportunity to seize a position at zero cost. This strategic move not only mitigates financial risk but also aligns well with our objectives in the competition.

Moreover, with the added incentive of competition prizes, the potential for substantial returns is heightened. I am keen to hear your thoughts on this matter and welcome any insights or feedback you may have.

What are your thoughts on participating in the Swap Competition under these circumstances? Witch strategy is better to leveraging this opportunity to optimize our position and performance?

Thank you for your attention and consideration.

7 Likes

I will share my strategy about the swap competition.

As you rightly said before, there are moments during which opening a position is practically cost-free, if not negative.

I always tend to open speculative operations for the Swap competition precisely in these moments.

I’m not a trader, so I don’t know technical analysis and chart patterns. Therefore, the only thing that influences my decisions regarding the competition is the cost of the premium.

Sometimes I also like to open two specular speculative positions, i.e., one long and one short at the same time, so as to definitely have a swap in profit and possibly enter the rankings.

Of course, I mainly use MetalSwap for hedging operations with completely different logics compared to what I adopt in this case for the competition. However, I also like to evolve my trading strategies and compete against our community.

5 Likes

I think a good way to participate in the competition is to position ourselves both long and short, as @Diego.crv also mentioned, with a 10% cover. This is a riskier move but it optimizes the profit percentage as calculated in the competition. I believe it is interesting to open as many positions as possible on assets that we expect to be more volatile, in this case, OP. It makes sense to do this with different addresses so that we increase the probability of ranking in the competition.

By opening many operations, we mitigate the risk of incurring liquidations and increase the probability of being placed in the competition rankings. This has a very low cost because the liquidity reward in OP significantly reduces the costs

4 Likes

Personally, I rarely trade but with the very low gas fees after Dencun upgrade and the premium cost covered by the rewards in OP, I’m participating in the swap competition for free. It’s impossible not to take advantage of these conditions!

2 Likes

I totally agree with you @Sephirot92

1 Like

I love the competitive atmosphere here because it’s a fun way to challenge me and a few of my friends to see who can beat each other

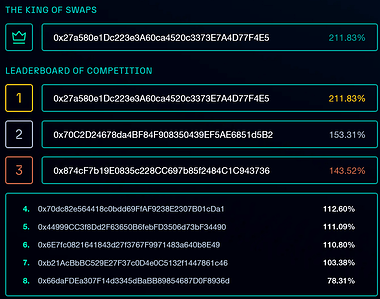

Keeping an eye on the top 7 of this competition, they did not bad at all already: all these people got over 100% profit, as well as getting OP prizes - and keeping the top positions until the end of the event, they’re also obtaining the Top20 leaderboard rewards

For the past few competitions I have been developing some strategies, mainly focusing on the optimization of entry points during low Premium costs periods, as some of you have mentioned, but not only that: I’m also opening similar positions during the same timeframe with different public addresses: I’m managing those positions differently depending on the market behaviour. This is obviously more risky if I can’t manage my position overtime. With this strategy, I enjoyed being in the Top10 during the previous competition - and more importantly: I beat my friends

If you’d like to know more about it, I’ll be glad to share and exchange insighs and strategies.

3 Likes